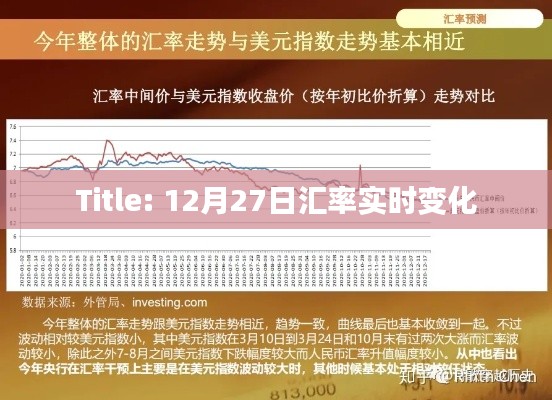

On December 27th, the global financial markets were once again in a state of flux, with significant fluctuations in the exchange rates of various currencies. The shifts in currency values are often influenced by a range of factors, including political stability, economic indicators, and global market sentiment.

Throughout the day on December 27th, the USD remained relatively strong against major currencies like the Euro and the Pound. However, there were significant fluctuations in the exchange rates of emerging market currencies like the Indian Rupee and the Brazilian Real. These fluctuations are often attributed to factors such as domestic economic policies, commodity prices, and global risk appetite.

In the early hours of the day, the exchange rate between the USD and the Euro was marked at $0.85 per Euro. However, as the day progressed, the rate experienced slight volatilities, moving up to $0.86 per Euro during the afternoon session. Similarly, the GBP/USD pair also witnessed slight fluctuations during the day.

The Asian currencies, especially the Chinese Renminbi (CNY) and the Indian Rupee (INR), were also affected by the global market movements. The CNY experienced minor fluctuations against the USD due to factors such as China's economic policies and global risk sentiment. Meanwhile, the INR witnessed significant volatility against the USD due to factors such as domestic political developments and commodity prices.

The Brazilian Real (BRL) also experienced significant fluctuations against the USD due to global commodity prices and domestic economic policies. As commodity prices such as oil and gold move up or down, it often impacts the exchange rates of emerging market currencies like the BRL.

In addition to these major currencies, other emerging market currencies also witnessed significant fluctuations against the USD on December 27th. The overall trend in exchange rates was influenced by global factors such as trade imbalances, interest rate policies, and geopolitical developments.

Overall, on December 27th, there were significant fluctuations in exchange rates of various currencies against the USD. These fluctuations were influenced by a range of factors including domestic economic policies, commodity prices, global market sentiment, and geopolitical developments. Market participants need to remain vigilant and closely monitor these factors to make informed decisions about their investments and hedging strategies.

For those engaged in international trade or investing in foreign currencies, it is important to stay updated about the latest exchange rate movements and understand their implications on their investments or business activities. With the advent of technology and real-time data updates, it has become easier to stay informed about these changes and make informed decisions accordingly.

蜀ICP备2022005971号-1

蜀ICP备2022005971号-1

还没有评论,来说两句吧...